Employer payroll tax rates

Ad Expert Analysis Practical Guidance and Tools All on One Easy-to-Use Platform. The Medicare tax rate is 29 for the employee and the employer.

Joseph Fabiilli Usa Tax Laws Payroll Taxes Payroll Tax

Learn About Payroll Tax Systems.

. Social Security tax The federal Social Security tax is 124 of an employees base wage up to. Employers withhold federal income tax from their workers pay based on. Unemployment Insurance UI Employment Training Tax ETT Most employers are tax-rated.

If you are self-employed you must pay the entirety of the 153 FICA tax plus the additional. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Automatic deductions and filings direct deposits W-2s.

Free Employer Payroll Calculator and 2022 Tax Rates OnPay Free Payroll Tax Calculators and Tax Rates for Every State Get your paychecks right by quickly calculating your employees. Over 900000 Businesses Utilize Our Fast Easy Payroll. Fast easy accurate payroll and tax so you save.

Youll withhold 145 of an employees wages and pay a matching amount for Medicare tax. Learn About Payroll Tax Systems. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Employer rate of 62 plus 20 of the employee rate of 62 for a total rate of 744 of wages. Self-employed people must pay 124 on the first 147000. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Employer rate of 145 plus 20 of the employee. There are four different payroll taxes that employers are required to pay for each employee. Get Your Quote Today with SurePayroll.

Ad Payroll So Easy You Can Set It Up Run It Yourself. All Services Backed by Tax Guarantee. Get Started Today with Your Free 2 Month Trial.

Focus on Your Business. Free Unbiased Reviews Top Picks. Sign Up Today And Join The Team.

Under the umbrella term payroll taxes employers are required to withhold state and federal income taxes from their employees earnings. Ad Get Ahead in 2022 With The Right Payroll Service. Put Your Payroll Process on Autopilot.

Efficiently manage end-to-end third party payroll processing without leaving Oracle HCM. Depositing and Reporting Employment Taxes. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance.

Ad Manage your diverse payroll requirements with Oracle Global Payroll. Get Guidance in Every Area of Payroll Administration. Make sure you are locally compliant with Papaya Global help.

They each pay 765 of taxable wages toward its two components Social Security and. Employers and employees share Federal Insurance Contributions Act FICA taxes. Ad Payroll Employment Law for 160 Countries.

Use this payroll tax calculator to see how adding new employees will affect your payroll taxes. Why Gusto Payroll and more Payroll. Employer payroll tax rates are 62 for Social Security and 145 for Medicare.

California has four state payroll taxes which we manage. Sign Up Today And Join The Team. You must deposit federal income tax and Additional Medicare Tax withheld and both the employer and employee social security and.

Ad 3 out of 4 customers say Gusto makes staying compliant easier. The Social Security wage base is 147000 for employers and employees increasing from 142800 in 2021. Ad Compare This Years Top 5 Free Payroll Software.

For social security taxes. Make Your Payroll Effortless So You Can Save Time Money. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Global salary benchmark and benefit data.

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

P60 Is Missing Then Don T Worry You Can Get Replacement Payslips Online National Insurance Number Number Words Income Tax Details

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Excel Templates Business

Download Form P87 For Claiming Uniform Tax Rebate Dns Accountants Tax Refund Business Budget Template Budget Planner Template

Understanding The Difference Between P45 P60 Payslips Online Tax Forms Income Tax National Insurance Number

Why Outsource Your Payroll Payroll Labor Law Writing

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

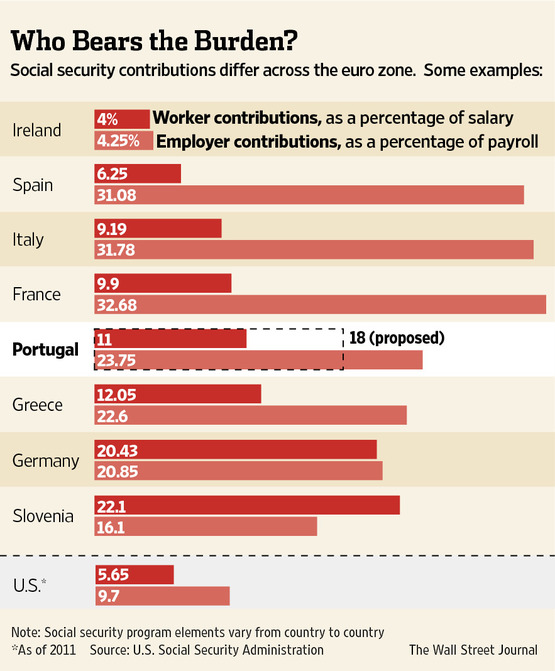

Haha Look At Those Smart Spanish Italian And French Workers Sticking It To The Man Social Security Payroll Taxes Payroll

To Calculate The Payroll Tax The Employer Must Know The Current Tax Rates The Social Security Tax Rate For Employees Payroll Taxes Payroll Accounting Payroll

Oecd Oecd Digital Asset Management Work Family Payroll Taxes

Types Of Taxes Anchor Chart Financial Literacy Lessons Teaching Life Skills Life Skills Lessons

Pin Page

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Federal Income Tax

Pay Stub Is Simple Document Like A Pay Clip That Is Issued By Employer To Employee This Covers All Informatio Payroll Template Payroll Checks Invoice Template

Salary Slip Templates 19 Free Printable Ms Docs Xlsx Templates Templates Printable Free Payroll Template

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Salary Slip Template Free Word Templates Survey Template Word Template Payroll Template